Navigating the world of mortgages can be a daunting task, but Rocket Mortgage aims to simplify the process, making it accessible and stress-free. With its innovative online platform and a commitment to customer support, Rocket Mortgage empowers homebuyers to secure their dream homes with ease.

In this comprehensive guide, we will delve into the intricacies of the Rocket Mortgage application, exploring its features, eligibility criteria, loan options, and the exceptional support system that sets it apart.

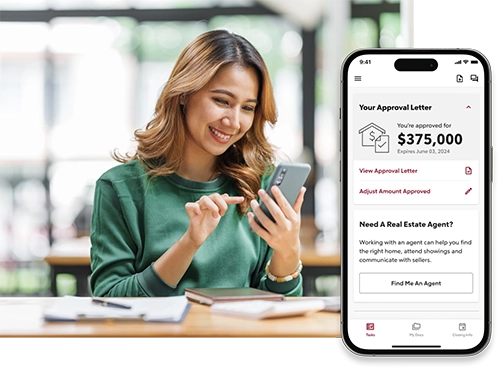

Rocket Mortgage’s online platform streamlines the application process, allowing you to complete it from the comfort of your own home. Its user-friendly interface and intuitive design guide you through each step, ensuring a seamless experience. The platform also provides real-time updates on your application status, keeping you informed at every stage.

Mortgage Application Process

Applying for a Rocket Mortgage is a straightforward process that can be completed entirely online. The online application process is designed to be user-friendly and efficient, allowing you to complete your application in as little as 10 minutes.To apply for a Rocket Mortgage, you will need to provide the following documentation:

- Your Social Security number

- Your driver’s license or state ID

- Your most recent pay stubs

- Your most recent bank statements

- Your W-2s from the past two years

Once you have gathered the necessary documentation, you can begin the online application process by visiting Rocket Mortgage’s website. The application process is divided into four simple steps:

- Provide your personal information

- Provide your financial information

- Review your application

- Submit your application

After you have submitted your application, Rocket Mortgage will review your information and make a decision on your loan application. You will typically receive a decision within 24 hours.

Rocket Mortgage Features

Rocket Mortgage revolutionizes the mortgage process with its cutting-edge features. Its user-friendly online platform empowers homebuyers with unparalleled convenience and efficiency, making the traditionally cumbersome process of obtaining a mortgage effortless and stress-free.

Here’s an overview of Rocket Mortgage’s distinctive features and how they simplify the mortgage application journey:

Online Application Process

Rocket Mortgage’s fully digital platform eliminates the need for physical paperwork and in-person meetings. Homebuyers can conveniently complete their entire mortgage application online, from the comfort of their own homes. The intuitive interface guides users through each step, making the process straightforward and accessible.

Instant Pre-Approval

Rocket Mortgage’s advanced technology provides instant pre-approval decisions, allowing homebuyers to determine their purchasing power within minutes. This expedites the home search process, enabling buyers to make informed decisions and focus on properties that align with their financial capabilities.

Personalized Loan Options

Rocket Mortgage offers a comprehensive range of loan options tailored to individual needs. Homebuyers can choose from various loan types, interest rates, and repayment terms to find the best fit for their financial situation and homeownership goals.

Streamlined Document Upload

Rocket Mortgage’s secure online portal allows homebuyers to upload required documents quickly and easily. The system automatically scans and verifies the documents, eliminating the hassle of manual processing and reducing the likelihood of errors.

Real-Time Status Updates

Homebuyers can track the progress of their mortgage application in real-time through Rocket Mortgage’s online platform. This transparency and constant access to information provide peace of mind and allow for proactive communication with loan officers.

Eligibility and Pre-Approval

To qualify for a Rocket Mortgage, you must meet certain eligibility criteria. These include having a stable income, a good credit score, and a debt-to-income ratio within Rocket Mortgage’s guidelines. You must also be able to provide documentation to support your income and assets.

Getting pre-approved for a Rocket Mortgage is a smart move. It shows sellers that you’re a serious buyer and it can help you get your offer accepted. Pre-approval also gives you a better idea of how much you can afford to borrow, so you can shop for a home with confidence.

Improving Your Chances of Getting Pre-Approved

- Check your credit score and make sure it’s as high as possible.

- Reduce your debt-to-income ratio by paying down debt or increasing your income.

- Get a steady job with a regular income.

- Have a good payment history on your bills.

- Save up for a down payment of at least 3{aecdf8555651034d2793f87101ce27bf4e3431d1e0c0e387cee7a17b30026e48}.

Loan Options and Rates

Rocket Mortgage offers a wide range of mortgage loan options to cater to diverse financial needs. Each loan type comes with unique features, interest rates, and repayment terms. Understanding these differences is crucial for choosing the loan that aligns with your specific circumstances and financial goals.

Fixed-Rate Mortgages

Fixed-rate mortgages provide stability and predictability as the interest rate remains constant throughout the loan term. This option is ideal for borrowers who prefer a consistent monthly payment and want to avoid fluctuations in interest rates.

Adjustable-Rate Mortgages (ARMs)

ARMs offer lower initial interest rates compared to fixed-rate mortgages. However, the interest rate can adjust periodically, typically based on market conditions. ARMs can be a good choice for borrowers who expect interest rates to remain low or anticipate moving before the rate adjustment period.

Compare Interest Rates and Loan Terms

Interest rates and loan terms vary depending on the loan type, credit score, loan amount, and market conditions. It’s essential to compare interest rates from multiple lenders to secure the most competitive rate. Rocket Mortgage provides transparent and real-time rate quotes, enabling you to make informed decisions.

Choosing the Best Loan Option

Selecting the right loan option requires careful consideration of your financial situation, risk tolerance, and long-term goals. Consider the following factors:*

-*Loan amount and down payment

Determine the amount you need to borrow and the down payment you can afford.

-

- -*Interest rate and loan term

Evaluate the interest rates and loan terms available to find the combination that suits your budget and financial goals.

- -*Interest rate and loan term

-*Fixed vs. adjustable

Decide whether the stability of a fixed-rate mortgage or the potential savings of an ARM align better with your preferences.

-*Credit score and debt-to-income ratio

Your credit score and debt-to-income ratio influence the interest rates and loan terms you qualify for.

By thoroughly evaluating your options and seeking guidance from a mortgage professional, you can make an informed decision that aligns with your financial objectives and sets you on the path to successful homeownership.

Application Status and Tracking

Once you’ve submitted your Rocket Mortgage application, you can easily track its progress online or through the Rocket Mortgage mobile app.

We’ll keep you updated throughout the process via email, text, and phone calls. You can also check the status of your application at any time by logging into your account or contacting your Loan Officer.

Contacting Rocket Mortgage

If you have any questions or need assistance during the application process, you can contact Rocket Mortgage in the following ways:

- Online: Log into your account and send a message through the secure messaging system.

- Phone: Call the Rocket Mortgage customer service line at (888) 452-0212.

- Email: Send an email to customerservice@rocketmortgage.com.

- In-person: Visit a Rocket Mortgage branch location.

Customer Support and Resources

Rocket Mortgage prioritizes customer satisfaction and provides comprehensive support throughout the application process. Applicants can access assistance through multiple channels:

-

- -*Online Chat

Engage with knowledgeable representatives in real-time through the Rocket Mortgage website.

- -*Online Chat

-*Phone Support

Call the dedicated customer service hotline for immediate assistance.

Submit inquiries via email and receive prompt responses from the support team.

Resources and Tools

Rocket Mortgage offers an array of resources to streamline the application process:

-

- -*Mortgage Calculator

Estimate monthly payments and compare loan options based on loan amount, interest rate, and loan term.

- -*Mortgage Calculator

-*Home Affordability Calculator

Determine how much you can afford to borrow based on your income, expenses, and down payment.

-*Rate Watch Tool

Monitor interest rate trends and receive alerts when rates change.

-*Document Checklist

Access a comprehensive list of required documents to expedite the application process.

Accessibility and Responsiveness

Rocket Mortgage’s customer service team is highly accessible and responsive:

-

- -*Extended Hours

Support is available seven days a week, including evenings and weekends.

- -*Extended Hours

-*Knowledgeable Representatives

Trained representatives provide accurate and timely information.

-*Personalized Assistance

Applicants receive dedicated support tailored to their specific needs and circumstances.

Security and Privacy

Rocket Mortgage takes the security and privacy of its applicants’ information very seriously. The company employs a range of robust security measures to protect your data, including:

- 256-bit encryption

- Multi-factor authentication

- Regular security audits

- Dedicated security team

Privacy Policies

Rocket Mortgage adheres to strict privacy policies that ensure the confidentiality of your personal and financial information. The company will never share your data with third parties without your explicit consent.

Final Conclusion

Whether you’re a first-time homebuyer or an experienced homeowner, Rocket Mortgage offers a tailored solution that meets your unique needs. Its diverse loan options, competitive interest rates, and personalized guidance empower you to make informed decisions about your mortgage. With Rocket Mortgage, you can embark on the journey towards homeownership with confidence, knowing that you have a trusted partner by your side.