Navigating the complexities of mortgage financing can be daunting, but the Zillow mortgage calculator simplifies the process by providing a comprehensive and user-friendly tool. With its advanced features and intuitive interface, it empowers homebuyers and real estate professionals alike to make informed decisions about their mortgage options.

The Zillow mortgage calculator is a powerful tool that seamlessly integrates into the homebuying process, enabling users to estimate monthly payments, compare loan options, and refine their mortgage strategies with ease. Its comprehensive functionality and customizable parameters make it an invaluable resource for anyone seeking to optimize their mortgage experience.

Zillow Mortgage Calculator

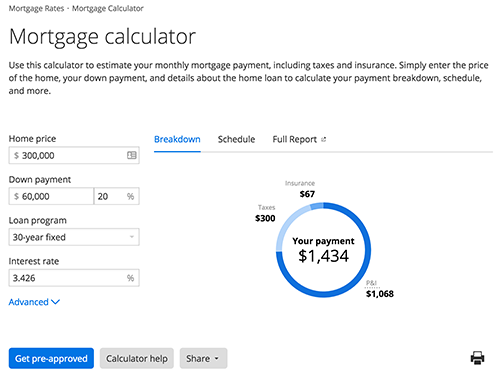

The Zillow Mortgage Calculator is a free online tool that helps users estimate their monthly mortgage payments and compare different loan options. It is designed to be user-friendly and provides detailed information about the loan, including the principal, interest, taxes, and insurance (PITI).

Key Features and Benefits

The Zillow Mortgage Calculator offers several key features and benefits:

- Easy to use: The calculator is straightforward and easy to use, with a simple interface that requires only basic information.

- Comprehensive results: The calculator provides detailed information about the loan, including the monthly payment, principal, interest, taxes, and insurance (PITI).

- Multiple loan options: Users can compare different loan options, including fixed-rate and adjustable-rate mortgages (ARMs).

- Save and share: Users can save and share their calculations, making it easy to track and compare different loan scenarios.

Examples of Use

The Zillow Mortgage Calculator can be used to estimate mortgage payments in various scenarios:

- Purchasing a home: Users can input the purchase price, down payment, and loan term to estimate their monthly mortgage payments.

- Refinancing a mortgage: Users can input their current loan information and compare it to different refinancing options to determine if they can save money.

- Comparing loan options: Users can compare different loan options, such as fixed-rate and adjustable-rate mortgages (ARMs), to determine which option is best for their financial situation.

Input Parameters and Calculations

To calculate mortgage payments, Zillow Mortgage Calculator requires several input parameters:

- Loan amount: The amount of money you borrow to purchase a home.

- Loan term: The length of time you have to repay the loan, typically 15 or 30 years.

- Interest rate: The percentage of the loan amount you pay each year as interest.

- Down payment: The amount of money you pay upfront to purchase a home, which reduces the loan amount.

- Property taxes: The annual taxes you pay on your home.

- Homeowners insurance: The annual insurance you pay to protect your home from damage.

- Private mortgage insurance (PMI): An additional insurance you may pay if your down payment is less than 20{aecdf8555651034d2793f87101ce27bf4e3431d1e0c0e387cee7a17b30026e48} of the loan amount.

The calculator uses these parameters to calculate your monthly mortgage payment using the following formula:

Monthly Payment = P

- (r

- (1 + r)^n) / ((1 + r)^n

- 1)

Where:

- P is the loan amount

- r is the monthly interest rate (annual interest rate / 12)

- n is the number of months in the loan term

The calculator also considers property taxes, homeowners insurance, and PMI (if applicable) to calculate your total monthly housing payment.

Customization and Refinement

Zillow’s Mortgage Calculator offers a wide range of customization options to tailor the calculations to your specific needs and preferences. You can adjust various parameters to refine your mortgage estimates and gain a more accurate understanding of your potential monthly payments.

By leveraging these customization features, you can explore different scenarios, compare mortgage options, and make informed decisions about your home financing.

Adjustable Parameters

The calculator allows you to adjust the following parameters:

- Loan amount

- Loan term (in years)

- Interest rate

- Property taxes

- Homeowners insurance

- HOA fees (if applicable)

- Down payment

- Mortgage type (fixed-rate or adjustable-rate)

- Loan purpose (purchase or refinance)

Impact of Customization

Adjusting these parameters can significantly impact the calculated monthly payments. For example, increasing the loan amount will increase the monthly payment, while increasing the down payment will decrease it. Similarly, a higher interest rate will lead to higher monthly payments, while a lower interest rate will result in lower payments.

By customizing the calculator’s parameters, you can refine your estimates and get a more personalized understanding of your mortgage affordability and potential monthly expenses.

4. Output and Interpretation

The Zillow Mortgage Calculator provides a detailed breakdown of the estimated monthly mortgage payments, interest rates, and loan terms based on the input parameters. The output is presented in a clear and concise manner, making it easy for users to understand and compare different loan options.

To interpret the results, it is important to pay attention to the following key metrics:

Monthly Mortgage Payment

This represents the estimated monthly payment that the borrower will need to make, including principal, interest, property taxes, and insurance (if applicable). The calculator provides an amortization schedule that shows how the monthly payment is applied to the principal and interest over the life of the loan.

Interest Rate

The interest rate is the percentage of the loan amount that the borrower will pay over the life of the loan. A higher interest rate will result in higher monthly payments and a greater total cost of the loan.

Loan Term

The loan term is the length of time that the borrower will have to repay the loan. A longer loan term will result in lower monthly payments but a higher total cost of the loan due to the additional interest that will be paid.

Limitations and Accuracy

It is important to note that the estimates provided by the Zillow Mortgage Calculator are just that – estimates. The actual monthly payment and loan terms may vary depending on a number of factors, such as the borrower’s credit score, the property’s location, and the lender’s underwriting guidelines.

Comparison with Other Calculators

The Zillow mortgage calculator is a powerful tool for estimating mortgage payments and affordability. However, it is important to compare it with other similar calculators to understand its unique features and advantages.

Popular Mortgage Calculators

There are several popular mortgage calculators available online, including those from Bankrate, NerdWallet, and LendingTree. Each calculator offers a range of features and functionality, catering to different user needs.

Unique Features of Zillow Mortgage Calculator

* Home Value Estimator: Zillow integrates with its home value estimator, providing users with an estimate of their home’s value before they start the mortgage calculation process.

Interactive Graphs

Zillow’s calculator generates interactive graphs that visualize the impact of different loan terms and interest rates on monthly payments and total interest paid.

Refinancing Comparison

Zillow allows users to compare refinancing options with their current mortgage, providing insights into potential savings and cost reductions.

Key Differences Between Calculators

The following table summarizes the key differences between the Zillow mortgage calculator and other popular calculators:| Feature | Zillow | Bankrate | NerdWallet | LendingTree ||—|—|—|—|—|| Home Value Estimator | Yes | No | No | No || Interactive Graphs | Yes | Yes | No | Yes || Refinancing Comparison | Yes | Yes | No | Yes || Loan Type Options | Limited | Extensive | Extensive | Extensive || Advanced Customization | Limited | Extensive | Extensive | Extensive |

Conclusion

The Zillow mortgage calculator offers a unique combination of features and advantages, including a home value estimator, interactive graphs, and refinancing comparison. However, it is important to compare it with other calculators to find the one that best meets your specific needs.

Integration and Usage

The Zillow Mortgage Calculator offers seamless integration options for websites and mobile apps, empowering businesses and individuals to enhance their real estate endeavors.By incorporating the calculator into their platforms, websites and apps can provide valuable resources to potential homebuyers and real estate professionals.

The calculator empowers users to make informed financial decisions by simulating mortgage scenarios and estimating monthly payments, interest rates, and loan terms.

Benefits for Real Estate Professionals

-

- -*Lead Generation

The calculator attracts potential clients seeking mortgage information, expanding the reach of real estate professionals.

- -*Lead Generation

-*Enhanced Customer Service

The calculator provides instant and accurate mortgage estimates, enabling realtors to respond promptly to client inquiries.

-*Professional Credibility

Integration of the calculator demonstrates expertise and commitment to providing comprehensive real estate services.

Benefits for Homebuyers

-

- -*Informed Decision-Making

The calculator empowers homebuyers to explore various mortgage options, allowing them to compare costs and make well-informed choices.

- -*Informed Decision-Making

-*Personalized Estimates

By entering their specific financial information, homebuyers can obtain customized mortgage estimates tailored to their individual circumstances.

-*Enhanced Confidence

The calculator reduces uncertainty by providing clear and detailed estimates, giving homebuyers confidence in their financial planning.

Closure

In conclusion, the Zillow mortgage calculator is an indispensable tool that empowers homebuyers and real estate professionals with the knowledge and insights necessary to make informed decisions about mortgage financing. Its user-friendly interface, customizable parameters, and comprehensive output provide a holistic view of mortgage options, simplifying the homebuying process and ensuring financial success.